Taxes, Pure Vermont Software, and the Green Valley

This commentary about the proposed “Cloud Computing Tax” is from VTTA member business Green River, originally posted on its site.

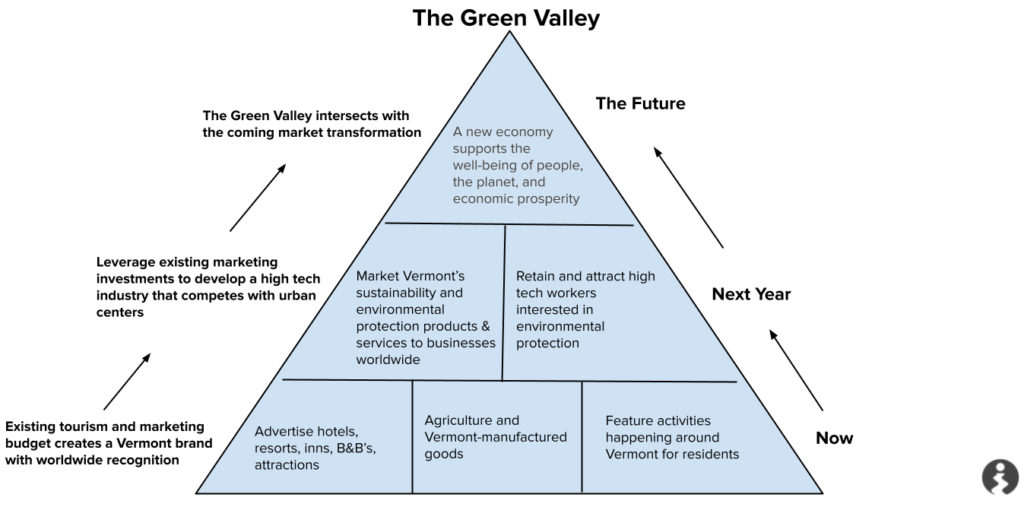

We like to think that—like maple syrup—there is something special about the tech industry in Vermont: something very Vermont; something about the people, our workspaces, our off-hours endeavors and hobbies, our environmental and sustainability ethos; something that makes Green River and our colleagues from Brattleboro to Burlington different from Silicon Valley. Something that makes us the Green Valley.

This, in fact, was one of Green River CEO Michael Knapp’s points last week when he testified before Vermont’s Senate Committee on Finance in opposition to a proposed “cloud tax.” The tax, under consideration in S.53, a bill related to sales and use tax exemptions, would ensure Vermont’s 6-percent sales tax applies to software that is “accessed remotely.” As currently understood, the tax would therefore be levied on all manner of cloud activity—from SaaS (software as a service) to PaaS and IaaS (platform and infrastructure as a service).

The cloud tax, in short, would apply to nearly everything Green River does, uses, and offers. That, as Michael testified, is something Green River cannot support—though not, importantly, for the corporate profit-seeking and -protecting reasons typically associated with an anti-tax position.

On the face of it, a cloud tax would seem to have its merits. Software wrapped in a box and purchased at a store has long been taxed (think installation disks), and uncontroversially so. Shouldn’t the same software purchased via the cloud likewise be taxed? And as the modern economy goes ever more digital, as more goods and services transition from bricks-and-mortar to the cloud, should not sales tax policy similarly refocus?

Moreover, Michael explained to the Senate committee, Green River would generally take a pro-tax stance on many initiatives, by no means rejecting out of hand every tariff imposed on the tech industry. For personal and professional reasons alike, there is no appetite at Green River to live in an especially low-tax state. There is, conversely, a strong interest in taxes that foster and bolster what we value, from education to public health to climate change mitigation to sustainable economic activity.

But the proposed cloud tax would not do that. It would, Michael contended, threaten the Green Valley just as it is taking shape and therefore disincentivize the future we want to see in Vermont.

While Green River has enjoyed a two-decade arc of growth and success, we are no tech giant, and neither are the other software firms operating in Vermont. Rather, they are, by and large, stage one and two businesses, working to gain or maintain a foothold. For these firms especially (and for Green River) a cloud tax would represent a significant new cost and a consequential administrative burden—simply because the cloud is how tech firms do business today. For Green River, at least, the cloud is where our clients’ platforms are hosted, where data is stored, where employees timesheets are filed, where accounts and projects are managed… and on and on. After labor and health care costs, “the cloud” represents the largest expense category for a tech firm like Green River. And, further, the cross-border nature of software work now burdens even the smallest outfits with the need to devote personnel and retain external accounting services to untangle multi-state tax obligations and determine what is owed where. Worryingly, even without the cloud tax, we already see tech struggling in our immediate region of southeast Vermont. Companies in Brattleboro are closing, leaving, or contracting.

But this is not the case elsewhere. Cloud tax or not—fewer than half of U.S. states currently impose some version or elements of S.53—tech is surging across the country, and not just because COVID-19 stimulated remote work, online commerce, and virtual versions of pre-pandemic routines. And the pattern is clear: While rural regions suffer a tech gap, the field leaps forward not just in Silicon Valley but in large economic clusters like Boston-Cambridge, Pittsburgh, North Carolina’s Research Triangle, and the midsize cities and Big Ten college towns of the Midwest.

Those urban hubs are experiencing what the rural landscapes of Vermont need more of: Well-paying jobs; economically and environmentally sustainable jobs; jobs that attract younger demographics; in short, a resilient, vibrant future.

And that future represents the best of the Green Valley and its special brand of tech. If Green River’s work and public-interest and non-profit clientele are any indicator, the Green Valley has a unique take on what tech can do for communities. Vermont needs an industry that through effective software and data analytics can, at least in part, help improve public health, build better public schools, protect the environment, and champion social justice missions. It needs small, “artisanal” tech firms that reflect both the nature of Vermont tech and Vermont values.

But, to do that, Vermont cannot cede any further advantage to urban tech hubs. Those population centers already enjoy rich ecosystems of universities, broadband infrastructure, tech-savvy and tech-trained workforces, attractive health care and child care options, and cafés and nightlife and entertainment to match. Meanwhile, tech workers in Vermont must contend with low bandwidth, intermittent cell phone coverage, poor housing and rental stock, a paucity of lawyers, accountants, and insurers fluent in the industry, and, in the case of Brattleboro, the recent closure of two institutions of higher education.

The cloud tax is therefore not just expensive, it adds to the list of the Green Valley’s disadvantages. It is an expensive burden for an industry angling to bring the vibrant digital economy to Vermont. It represents even more incentive for tech to grow anywhere and everywhere but the Green Valley.